Landlord & Investor News

InvestmentLenderLandlordAirBnBBlanket LoanVacation RentalNEWS

Blog (214)

How to Choose the Right Home Security System for a Rental Property

Home security systems are not only meant for homeowners, they can also be used by landlords who rent out their property. If you are a newbie to the rental property scene or you are simply wondering which home security system is ideal for you, this article will explain how to choose the right security system for your rental property.

Home security systems are not only meant for homeowners, they can also be used by landlords who rent out their property. If you are a newbie to the rental property scene or you are simply wondering which home security system is ideal for you, this article will explain how to choose the right security system for your rental property.

Budget

Landlords are often required to operate their rental properties on a strict budget. Luckily, there are methods to economize on a home security system purchase without compromising quality. Installing the security system yourself can help you save a good amount of money, and most D-I-Y installations can be completed in an hour or so.

If you can devote your time to install the system yourself, make sure that you do it correctly. It can be a fantastic way to reduce your home security costs. Another great way to save money on an alarm system is to go for a hardwired system. Although wireless systems have their own benefits, wired systems are a more budget-friendly choice.

How To Be A Good Landlord – Tips, Advice & Responsibilities

Buying a rental property and becoming a landlord comes with a lot of responsibilities and unfortunately stress. A landlord generally deals with tenants and their complaints, high dollar property repairs and many other endless rent tax issues. All these things turn a well-meaning property owner into a jaded landlord.

Buying a rental property and becoming a landlord comes with a lot of responsibilities and unfortunately stress. A landlord generally deals with tenants and their complaints, high dollar property repairs and many other endless rent tax issues. All these things turn a well-meaning property owner into a jaded landlord.

Oftentimes, as a landlord, it is easy to see your tenants as dollar signs, instead on building a good tenant/landlord relationship. But, establishing a good relation with your tenants and marketing yourself as a good landlord has various benefits. You won't be having any disputes with your tenants over repairs or maintenance. Your tenants are more likely to renew the lease even with a rent increase.

Following are seven tips you can utilize to be a great landlord.

1. Customize the Lease

You can get a standard lease form online or from any office supply store. This will cover the basics of lease, including rent, security deposit cost and legal terms and conditions. You can consider adding any special rules and include late payment fees to maintenance responsibilities. A clear lease with all do's and dont's mentioned, will reduce friction between you and your tenants.

2. Know the Laws

Each state has a landlord and tenant act that covers rent, security deposits, rights and duties of landlord and tenant. You can get the copy of these terms from the Department of Housing office in your area. Get to know about the laws and your duties towards your tenants. In worst-case scenario, violating a tenant’s right may lead you to the civil court.

Here are 10 Questions that Your Home Inspector Should Answer

A home inspector plays an important role in your buy-to-rent property purchase. Below are 10 important questions that you must ask a home inspector before hiring them:

A home inspector plays an important role in your buy-to-rent property purchase. Below are 10 important questions that you must ask a home inspector before hiring them:

1. What does your inspection cover?

The inspector should ensure that their inspection and inspection report will meet all your requirements and will comply with the code of ethics. You should be able to ask any questions and check if all the areas are inspected or not.

How To Be Better Real Estate Investor to Conquer Rental Property Arena

Better investing doesn't just happen accidentally. Good investors work it out full-time. They research, learn and understand the latest market trends in the rental industry of USA. Regardless of how much landlord experience you have, remember that the competition in the rental property market is fierce.

Better investing doesn't just happen accidentally. Good investors work it out full-time. They research, learn and understand the latest market trends in the rental industry of USA. Regardless of how much landlord experience you have, remember that the competition in the rental property market is fierce.

From big investors to newbies, the number of investors seeking rental property at good locations is soaring day by day. Here you will find some tips that will help you enhance your skills to be a better rental property investor and always stay ahead of your competition.

Network with wholesalers

Finding investment properties in your area with strong rental income fundamentals is the key to success. This is where wholesalers (people who sell properties at a cheaper rate than market price) can help you secure the best deal. If you are new to the investment market, you must become well acquainted with the wholesalers in your area. You can research the real estate investment groups that operate in your area. Try to attend their events to know the latest property trends. If you are a long-term investor, it is advised to renew your contacts with wholesalers so that they contact you first if there's a good property deal available.

Rental Property Lending with Blanket Loans

Rental Property Lending with Blanket Loans

A blanket mortgage is a type of rental property lending that allows the purchase of multiple parcels of real estate under the shade of a single mortgage. The finance of all the properties is taken as collateral by the creditor.

During the release clause, the integrity of the mortgage can remain unharmed if one or more real estate parcels within the blanket are sold. For example, if an investor acquired a blanket mortgage to purchase six buildings and sold two of them, he/she would still maintain the blanket mortgage for the remaining four properties. A blanket mortgage is often used by real estate developers to finance the purchase and development of land.

The Benefits of Blanket Mortgages with Rental Property Lending

Blanket mortgages offer a more efficient, cost-effective way for real estate investors to acquire financing. For a real estate investor, the alternative to a blanket mortgage would be to obtain separate mortgages for each property. For instance, if a company were planning to build a subdivision with 30 houses, it would need to take out 30 separate mortgages to finance the purchase and construction of the 30 homes.

Complete Guide to Landlord Financing

Is Buy-to-Rent a Gold Mine as Advertised for Landlord Financing Investors?

What is Buy-to-Rent for Landlord Financing?

What is Buy-to-Rent for Landlord Financing?

Buy-to-rent is pretty much what it sounds like – you buy a real estate property for the purpose of renting it out to tenants. Landlord financing is available because as a future landlord, you are making an investment we can help finance. Why? Because becoming a landlord is just like becoming a small business owner. Your property acts as a medium to long-term investment, but also as a business with proven resources and credibility worthy to finance. Buy-to-rent investment varies a lot from owning your own home.

Is the buy-to-rent market a wise area for landlord finance investing?

The short answer is yes. The buy-to-rent market has grown and continues to grow, thanks to an increasing population that has led to a shortfall in available properties in U.S.

What else drives the rental market for landlord financing?

7 Relatively Unknown Benefits of Investing in a Single-Family Home

Real estate investment is considered as one of the best business practices one can make with their money. This year, general contractors have seen a jump in investing for single-family homes as compared to other types of real estate. The price of a single-family rental home looks more attractive for beginer investors and adds a great start to a portfolio or quick portfolio add-on.

Real estate investment is considered as one of the best business practices one can make with their money. This year, general contractors have seen a jump in investing for single-family homes as compared to other types of real estate. The price of a single-family rental home looks more attractive for beginer investors and adds a great start to a portfolio or quick portfolio add-on.

It's no surprise why there are so many investment opportunities in this market, as home prices experienced a major drop in certain areas in Canada. Read on for benefits of investing in a single-family home:

Asset-Based Lending and Real Estate Investments

Real estate investments are now faster and easier with asset-based lending, it's the next step in real estate investments. Are you looking for working capital to support your real estate investment so that you can acquire more rental properties and make more profits? One of the best ways to acquire the financing you need is – asset-based lending.

This is a loan that is backed by assets such as properties you’ve purchased or accounts receivable from rentals such as a DSCR no ratio loan. It's the next step for real estate investing. Your personal finance as a real estate investor has much less influence on your loan than the value of your property.

Asset-based lending has recently become accessible all over U.S to owners of single-family rentals, condos, two- to four-unit properties, and townhomes; allowing seasoned investors to reach even the most expensive markets.

The Basics of Asset-Based Lending

This type of lending is based on assets used as collateral for a loan. These assets are real estate assets and not personal assets. To secure the loan, and eliminate any downsides, make sure that the financial information about your properties is both precise and accurate. Having a professional prepare financial statements and photos will help the lenders determine your property's value.

8 Step Ultimate Guide to Keep Your Tenants Happy

A happy tenant often means a happy landlord. When a landlord has a good relationship with their tenant, issues such as property damage, late or no payment of rent can be reduced to a certain level.

A happy tenant often means a happy landlord. When a landlord has a good relationship with their tenant, issues such as property damage, late or no payment of rent can be reduced to a certain level.

While it is beneficial for a landlord, building and maintaining a good relationship needs some work. You can't build a good relation with your tenants by merely putting them into a property or by keeping an eye on every activity of your tenant.

Below is the list of key things to consider when building a great relationship with your tenants:

What's Better For the SFR Investor – Capital Expenditures or Routine Repairs?

Financing for a single-family rental investment is generally based on the principles of commercial lending that include a capital expenditure reserve. For some residential investors, capital expenditure terminology — CapEx for short — is unfamiliar. Capital expenditure reserves are common in the commercial real estate but lesser known in the residential real estate space.

Financing for a single-family rental investment is generally based on the principles of commercial lending that include a capital expenditure reserve. For some residential investors, capital expenditure terminology — CapEx for short — is unfamiliar. Capital expenditure reserves are common in the commercial real estate but lesser known in the residential real estate space.

CAPITAL EXPENDITURE

A capital expenditure is something that can be capitalized over a stipulated period. It either adds or upgrades the physical assets of a property. Basically, it is a one-time huge expense.

Examples of capital expenditure include a new roof, flooring or appliance. It can also include installation of a new heating and cooling system or undertaking maintenance of an existing HVAC system. The same goes for new plumbing or major electrical work.

Keep Pests Out of Your Rental Property!

Pests – roaches, ants, termites and so on – can create a huge nuisance at any premises. Rental properties are no different. Keeping pests out of the rental property is a year round job. Pest infestation can seriously affect the structural integrity of your investment. If you are dealing with a home that seems consistently plagued by pests, here are a few simple tips to eradicate these varmints from your property:

Pests – roaches, ants, termites and so on – can create a huge nuisance at any premises. Rental properties are no different. Keeping pests out of the rental property is a year round job. Pest infestation can seriously affect the structural integrity of your investment. If you are dealing with a home that seems consistently plagued by pests, here are a few simple tips to eradicate these varmints from your property:

Don’t Feed or Water the Pests

Simple enough, pests roam around in search of food and water. Learn what particular pests eat and try to eliminate those sources. If you have tenants, ask them to keep the property dry and clean. Don't give the pests any reason to get inside your premises.

Everything Investors Always Wanted to Know About Yield Maintenance

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

What is Yield Maintenance & How It Works?

Yield maintenance is a prepayment premium that allows investors to attain the same yield as if the borrower made all scheduled mortgage payments until maturity. Yield maintenance is common in the commercial mortgage market, but only a few investors know about it in the residential lending market, so investors who are mainly associated with residential loans may not be familiar with how it works.

7 Relatively Unknown Benefits of Investing in a Single-Family Home

Real estate investment is considered as one of the best business practices one can make with their money. This year has seen a hype in investing for single-family homes as compared to other types of real estate.

Real estate investment is considered as one of the best business practices one can make with their money. This year has seen a hype in investing for single-family homes as compared to other types of real estate.

It's no surprise why there are so many investment opportunities in this market, as home prices experienced a major drop in certain areas in Canada. Read on for benefits of investing in a single-family home:

1. Low Turnover Rates

Lower turnover rate is one of the key benefits in single-family housing. Vacancy equals loss of income as well as expenses making the property ready for the next tenant.

Each that a tenant leaves, there will be additional costs of new paint, carpeting, hardware and more. Considering the fact that single-family homes have a much lower turnover rate—there will be significantly less monetary rise due to vacant space.

Rental Property Insurance – Cover Your Rental Business with Safety Net

Written by Rental Home FinancingWhy Real Estate Investors Should Consider Property Insurance Coverage

Rental real estate is one promising investment, featuring the dual advantages of rental income and long-term capital growth. However, as risk always comes with a reward, a real estate investor must be adequately protected from the unforeseen — with property insurance coverage.

Rental real estate is one promising investment, featuring the dual advantages of rental income and long-term capital growth. However, as risk always comes with a reward, a real estate investor must be adequately protected from the unforeseen — with property insurance coverage.

If you think that finding a good tenant for your property will melt away all your troubles, think again. If you own a real estate property, you need to realize the unique risks you may face. And more importantly — how to shield against them.

Make Your Rental Property Spring-Ready Without Breaking the Bank

Spring is just around the corner. That means many renters will now be looking for a rental property to move into. Landlords all over U.S. must gear up to do some spring cleaning on their rental properties. Cleaning and maintaining your property doesn't only have to happen only in spring, but this time of the year is great to get up close and personal with your property to look for issues or problems that 'Old Man Winter' left behind.

Spring is just around the corner. That means many renters will now be looking for a rental property to move into. Landlords all over U.S. must gear up to do some spring cleaning on their rental properties. Cleaning and maintaining your property doesn't only have to happen only in spring, but this time of the year is great to get up close and personal with your property to look for issues or problems that 'Old Man Winter' left behind.

Also, some repairs and fixes are impossible to do when the weather is freezing cold. So it's better to take advantage of the warmer weather to check on things. After all, warmer days bring a warmer rental market.

Here a few tips to help you attract new tenants to vacant properties without breaking the bank:

More...

5 Ultimate Tips to Know When Refinancing Rental Property Mortgage

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners face a fair share of hurdles during the rental mortgage refinancing process. They need to know how to overcome those hurdles to get a new mortgage for their properties quickly.

There are some key considerations that must be kept in mind when planning to refinance your rental portfolio.

1. Know your Rental Investment Properties

When exploring your potential lending options in refinancing, it is important to have the most recent and accurate data on your assets. Acquisition date and price, current lease information, rehab expenses, maintenance/repair costs, insurance and taxes are some vital data that can lead you to the right financier. It is advised to organize the data in a clean excel file that is easy to understand for the lender.

Also, the lenders appreciate a recent property inspection report from a certified source. This will not only make you credible but also increase the available options.

Funding Real Estate Investments: Crowdfunding vs. Rental Property Loans

Which is the best option for financing real estate investments today; crowdfunding or rental property loans? Or can the two better be used together for superior returns?

Which is the best option for financing real estate investments today; crowdfunding or rental property loans? Or can the two better be used together for superior returns?

Crowdfunding continues to be a hot buzzing topic. The adoption of crowdfunding by major brands, and the emergence of new real estate specific crowdfunding platforms, along with masses of press coverage has made this form of fundraising even more popular.

Crowdfunding can be a great way to finance all types of things from honeymoons to new business startups to acquiring portfolios of single family rental properties. It doesn’t require putting personal credit on the line, can help spread risk, and promises to be a fun adventure.

However, crowdfunding can be far more intensive and expensive than most realize. Media stories of new startups landing millions via crowdfunding make it sound like a guaranteed path to overnight success and easy money.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.

What should real estate investors be looking for in a great investment property loan and mortgage lender?

Below are 6 criteria that we feel are important to consider when applying for an investment loan.

TOP 6 Investment Property Loan Considerations

1. Non-Recourse Loans

You want to make sure the loan is non recourse. Non-recourse loans are one type of investment property loan where the lending institution cannot come after the borrower for any reason if the loan defaults.

This type of loan is usually only given to very qualified borrowers with great credit scores and a large amount of equity in the property. This means that if you default on the loan, the lender can only go after the property itself and not your personal assets.

While he hasn’t always followed his own advice Donald Trump has said for decades that selecting non-recourse loans is the smart way to go to reduce liability, and separate personal from business and investment assets and debt leverage.

Rental Property Investors, Multifamily Mortgage Loans, Report

Rental Property Investors, Multifamily Mortgage Loans, Report

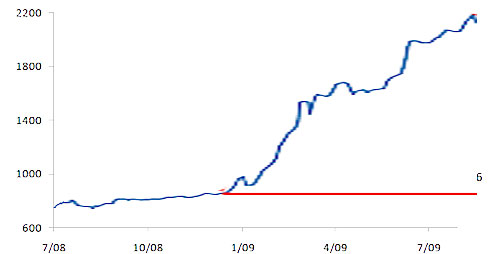

Smart investment property mortgages are one of the main tools fueling enhanced returns for intelligent income property investors seeking capital growth and more attractive yields.

Understanding of the performance enhancing benefits of new smart investment property loans explains the new values being placed on both single family rental homes and multifamily investment properties, and how the most sophisticated investors are creating spreads that were never possible before.

How Smart Leverage is Creating Recovery

Real estate investors have returned to the US market at all levels. The contribution to the economy has been dramatic. Each new home and renovated apartment complex has added both jobs and tax revenues to build up both the public and private sector across the nation.

Rental Home Financing

9465 Counselors Way

Suite #200,

Indianapolis, IN 46240

About Rental Home Financing:

Rental Home Financing, as the best mortgage lenders we originate rental home loan products and cash out refinance investment property loans as the best investment property refinance lenders. Commercial blanket loans are available with a commercial purpose to suit your needs.

Also, as DSCR loan specialists, we are currently authorized to make such loans in most all areas of the United States. Specific circumstances will determine whether we have the ability approve/close portfolio rental home loans in your state(s). When you are ready to get a mortgage for rental property, we are ready to serve you.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.