Your commercial real estate loan may have restrictions on prepayment. For the first few years of the loan term, the entire prepayment of the loan may be locked and then be open with a penalty based on yield maintenance. Prepayment restrictions can hamper business flexibility in case you need to refinance or sell the asset quickly. Thus, it is advised to the property investors to clearly understand the terms before signing the loan documents.

What Affects the Yield Maintenance Penalty?

The actual yield maintenance penalty cost is based on the movement of interest rates. The formula for the yield maintenance premium is:

Yield Maintenance = Present Value of Remaining Payments on the Mortgage x (Interest Rate - Treasury Rate)

Note that the Treasury rate should be of the same duration during which yield is calculated.

Almost all loans with more than a five-year term will have a yield maintenance penalty. The advantage for borrowers is that they are able to get a better interest rate on a loan with yield maintenance since the lender is protected from prepayment.

Why Yield Maintenance Important to You?

Yield Maintenance is a prepayment premium that allows lenders to attain the same yields when rates go down as if the borrower made all the mortgage payments until maturity.

Yield maintenance premiums are designed to make lenders indifferent to prepayments when the rates go down. The reason is, that the yield maintenance pays the lender the equivalent amount of money as if the loan had not been prepaid. Moreover, yield maintenance premiums also make refinancing unattractive to borrowers, when the rates are down.

Bottom line:

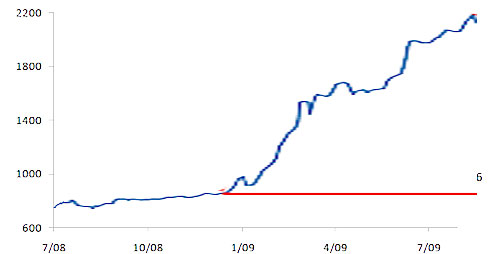

- If rates are up, there is no yield prepayment penalty

- If rates are down, there is a yield maintenance prepayment penalty

The decision to prepay a loan through yield maintenance should be based on economical, legal and strategic considerations. Favorable credit market rates and terms may drive your decision to prepay with penalty in order to improve the distributable cash flow. Make sure you carefully evaluate your prepayment options and engage qualified and experienced help to make the optional loan prepayment decision.

Rental Home Financing is a leading player in the financing and lending of the rental properties. Our veteran experts, including JackHeath, Doug Goins and David Esler, have years of experience in lending. If you still have questions about how yield maintenance works, feel free to discuss your thoughts with our lenders at Rental Property Finance.

Our rental home refinancing specialists will be more than happy to help you know more about yield maintenance penalty. Call 888-375-7977 Today to get more information directly from our experts.

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.