Landlord & Investor News

InvestmentLenderLandlordAirBnBBlanket LoanVacation RentalNEWS

Complete Guide to Landlord Financing

Is Buy-to-Rent a Gold Mine as Advertised for Landlord Financing Investors?

What is Buy-to-Rent for Landlord Financing?

What is Buy-to-Rent for Landlord Financing?

Buy-to-rent is pretty much what it sounds like – you buy a real estate property for the purpose of renting it out to tenants. Landlord financing is available because as a future landlord, you are making an investment we can help finance. Why? Because becoming a landlord is just like becoming a small business owner. Your property acts as a medium to long-term investment, but also as a business with proven resources and credibility worthy to finance. Buy-to-rent investment varies a lot from owning your own home.

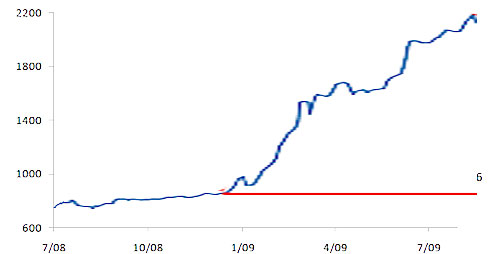

Is the buy-to-rent market a wise area for landlord finance investing?

The short answer is yes. The buy-to-rent market has grown and continues to grow, thanks to an increasing population that has led to a shortfall in available properties in U.S.

What else drives the rental market for landlord financing?

7 Relatively Unknown Benefits of Investing in a Single-Family Home

Real estate investment is considered as one of the best business practices one can make with their money. This year, general contractors have seen a jump in investing for single-family homes as compared to other types of real estate. The price of a single-family rental home looks more attractive for beginer investors and adds a great start to a portfolio or quick portfolio add-on.

Real estate investment is considered as one of the best business practices one can make with their money. This year, general contractors have seen a jump in investing for single-family homes as compared to other types of real estate. The price of a single-family rental home looks more attractive for beginer investors and adds a great start to a portfolio or quick portfolio add-on.

It's no surprise why there are so many investment opportunities in this market, as home prices experienced a major drop in certain areas in Canada. Read on for benefits of investing in a single-family home:

Asset-Based Lending and Real Estate Investments

Real estate investments are now faster and easier with asset-based lending, it's the next step in real estate investments. Are you looking for working capital to support your real estate investment so that you can acquire more rental properties and make more profits? One of the best ways to acquire the financing you need is – asset-based lending.

This is a loan that is backed by assets such as properties you’ve purchased or accounts receivable from rentals such as a DSCR no ratio loan. It's the next step for real estate investing. Your personal finance as a real estate investor has much less influence on your loan than the value of your property.

Asset-based lending has recently become accessible all over U.S to owners of single-family rentals, condos, two- to four-unit properties, and townhomes; allowing seasoned investors to reach even the most expensive markets.

The Basics of Asset-Based Lending

This type of lending is based on assets used as collateral for a loan. These assets are real estate assets and not personal assets. To secure the loan, and eliminate any downsides, make sure that the financial information about your properties is both precise and accurate. Having a professional prepare financial statements and photos will help the lenders determine your property's value.

8 Step Ultimate Guide to Keep Your Tenants Happy

A happy tenant often means a happy landlord. When a landlord has a good relationship with their tenant, issues such as property damage, late or no payment of rent can be reduced to a certain level.

A happy tenant often means a happy landlord. When a landlord has a good relationship with their tenant, issues such as property damage, late or no payment of rent can be reduced to a certain level.

While it is beneficial for a landlord, building and maintaining a good relationship needs some work. You can't build a good relation with your tenants by merely putting them into a property or by keeping an eye on every activity of your tenant.

Below is the list of key things to consider when building a great relationship with your tenants:

What's Better For the SFR Investor – Capital Expenditures or Routine Repairs?

Financing for a single-family rental investment is generally based on the principles of commercial lending that include a capital expenditure reserve. For some residential investors, capital expenditure terminology — CapEx for short — is unfamiliar. Capital expenditure reserves are common in the commercial real estate but lesser known in the residential real estate space.

Financing for a single-family rental investment is generally based on the principles of commercial lending that include a capital expenditure reserve. For some residential investors, capital expenditure terminology — CapEx for short — is unfamiliar. Capital expenditure reserves are common in the commercial real estate but lesser known in the residential real estate space.

CAPITAL EXPENDITURE

A capital expenditure is something that can be capitalized over a stipulated period. It either adds or upgrades the physical assets of a property. Basically, it is a one-time huge expense.

Examples of capital expenditure include a new roof, flooring or appliance. It can also include installation of a new heating and cooling system or undertaking maintenance of an existing HVAC system. The same goes for new plumbing or major electrical work.

Keep Pests Out of Your Rental Property!

Pests – roaches, ants, termites and so on – can create a huge nuisance at any premises. Rental properties are no different. Keeping pests out of the rental property is a year round job. Pest infestation can seriously affect the structural integrity of your investment. If you are dealing with a home that seems consistently plagued by pests, here are a few simple tips to eradicate these varmints from your property:

Pests – roaches, ants, termites and so on – can create a huge nuisance at any premises. Rental properties are no different. Keeping pests out of the rental property is a year round job. Pest infestation can seriously affect the structural integrity of your investment. If you are dealing with a home that seems consistently plagued by pests, here are a few simple tips to eradicate these varmints from your property:

Don’t Feed or Water the Pests

Simple enough, pests roam around in search of food and water. Learn what particular pests eat and try to eliminate those sources. If you have tenants, ask them to keep the property dry and clean. Don't give the pests any reason to get inside your premises.

Everything Investors Always Wanted to Know About Yield Maintenance

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

What is Yield Maintenance & How It Works?

Yield maintenance is a prepayment premium that allows investors to attain the same yield as if the borrower made all scheduled mortgage payments until maturity. Yield maintenance is common in the commercial mortgage market, but only a few investors know about it in the residential lending market, so investors who are mainly associated with residential loans may not be familiar with how it works.

7 Relatively Unknown Benefits of Investing in a Single-Family Home

Real estate investment is considered as one of the best business practices one can make with their money. This year has seen a hype in investing for single-family homes as compared to other types of real estate.

Real estate investment is considered as one of the best business practices one can make with their money. This year has seen a hype in investing for single-family homes as compared to other types of real estate.

It's no surprise why there are so many investment opportunities in this market, as home prices experienced a major drop in certain areas in Canada. Read on for benefits of investing in a single-family home:

1. Low Turnover Rates

Lower turnover rate is one of the key benefits in single-family housing. Vacancy equals loss of income as well as expenses making the property ready for the next tenant.

Each that a tenant leaves, there will be additional costs of new paint, carpeting, hardware and more. Considering the fact that single-family homes have a much lower turnover rate—there will be significantly less monetary rise due to vacant space.

Rental Property Insurance – Cover Your Rental Business with Safety Net

Written by Rental Home FinancingWhy Real Estate Investors Should Consider Property Insurance Coverage

Rental real estate is one promising investment, featuring the dual advantages of rental income and long-term capital growth. However, as risk always comes with a reward, a real estate investor must be adequately protected from the unforeseen — with property insurance coverage.

Rental real estate is one promising investment, featuring the dual advantages of rental income and long-term capital growth. However, as risk always comes with a reward, a real estate investor must be adequately protected from the unforeseen — with property insurance coverage.

If you think that finding a good tenant for your property will melt away all your troubles, think again. If you own a real estate property, you need to realize the unique risks you may face. And more importantly — how to shield against them.

More...

Make Your Rental Property Spring-Ready Without Breaking the Bank

Spring is just around the corner. That means many renters will now be looking for a rental property to move into. Landlords all over U.S. must gear up to do some spring cleaning on their rental properties. Cleaning and maintaining your property doesn't only have to happen only in spring, but this time of the year is great to get up close and personal with your property to look for issues or problems that 'Old Man Winter' left behind.

Spring is just around the corner. That means many renters will now be looking for a rental property to move into. Landlords all over U.S. must gear up to do some spring cleaning on their rental properties. Cleaning and maintaining your property doesn't only have to happen only in spring, but this time of the year is great to get up close and personal with your property to look for issues or problems that 'Old Man Winter' left behind.

Also, some repairs and fixes are impossible to do when the weather is freezing cold. So it's better to take advantage of the warmer weather to check on things. After all, warmer days bring a warmer rental market.

Here a few tips to help you attract new tenants to vacant properties without breaking the bank:

5 Ultimate Tips to Know When Refinancing Rental Property Mortgage

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners face a fair share of hurdles during the rental mortgage refinancing process. They need to know how to overcome those hurdles to get a new mortgage for their properties quickly.

There are some key considerations that must be kept in mind when planning to refinance your rental portfolio.

1. Know your Rental Investment Properties

When exploring your potential lending options in refinancing, it is important to have the most recent and accurate data on your assets. Acquisition date and price, current lease information, rehab expenses, maintenance/repair costs, insurance and taxes are some vital data that can lead you to the right financier. It is advised to organize the data in a clean excel file that is easy to understand for the lender.

Also, the lenders appreciate a recent property inspection report from a certified source. This will not only make you credible but also increase the available options.

Funding Real Estate Investments: Crowdfunding vs. Rental Property Loans

Which is the best option for financing real estate investments today; crowdfunding or rental property loans? Or can the two better be used together for superior returns?

Which is the best option for financing real estate investments today; crowdfunding or rental property loans? Or can the two better be used together for superior returns?

Crowdfunding continues to be a hot buzzing topic. The adoption of crowdfunding by major brands, and the emergence of new real estate specific crowdfunding platforms, along with masses of press coverage has made this form of fundraising even more popular.

Crowdfunding can be a great way to finance all types of things from honeymoons to new business startups to acquiring portfolios of single family rental properties. It doesn’t require putting personal credit on the line, can help spread risk, and promises to be a fun adventure.

However, crowdfunding can be far more intensive and expensive than most realize. Media stories of new startups landing millions via crowdfunding make it sound like a guaranteed path to overnight success and easy money.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.

What should real estate investors be looking for in a great investment property loan and mortgage lender?

Below are 6 criteria that we feel are important to consider when applying for an investment loan.

TOP 6 Investment Property Loan Considerations

1. Non-Recourse Loans

You want to make sure the loan is non recourse. Non-recourse loans are one type of investment property loan where the lending institution cannot come after the borrower for any reason if the loan defaults.

This type of loan is usually only given to very qualified borrowers with great credit scores and a large amount of equity in the property. This means that if you default on the loan, the lender can only go after the property itself and not your personal assets.

While he hasn’t always followed his own advice Donald Trump has said for decades that selecting non-recourse loans is the smart way to go to reduce liability, and separate personal from business and investment assets and debt leverage.

Rental Home Financing

9465 Counselors Way

Suite #200,

Indianapolis, IN 46240

About Rental Home Financing:

Rental Home Financing, as the best mortgage lenders we originate rental home loan products and cash out refinance investment property loans as the best investment property refinance lenders. Commercial blanket loans are available with a commercial purpose to suit your needs.

Also, as DSCR loan specialists, we are currently authorized to make such loans in most all areas of the United States. Specific circumstances will determine whether we have the ability approve/close portfolio rental home loans in your state(s). When you are ready to get a mortgage for rental property, we are ready to serve you.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.