Displaying items by tag: credit challenged

Refi Lending for Credit-Challenged Investors

Who is the best hard money loan lender to refinance with for the credit challenged?

Who is the best hard money loan lender to refinance with for the credit challenged?

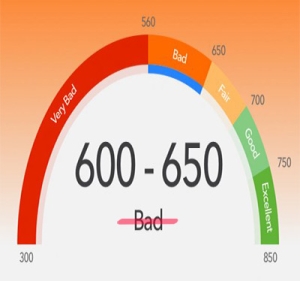

The best mortgage lenders & best refinance company is the best mortgage lenders for credit challenged! Among the top 2022 mortgage loan companies is RentalHomeFincing.com with international hard money loans. We can service loans with credit scores as low as 620.

As Hard money lenders, we specialize in helping those wanting to get into the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) and growing short-term rental market.

We can provide easy fast investment loans for anything from a single family home rental to a quad-plex, an apartment building, and even an entire commercial project of office buildings or strip malls.

The Best Mortgage Lenders Make Your Financial Dreams Come True

Have you ever wanted your own strip mall, apartment building, quadplex, or even just a single-family home rental but thought you would never qualify? We can help you achieve your dreams of becoming a real estate investor.

For anyone with a minimum credit score looking to refinance their investment property, rentalhomefinancing.com is the best choice. As short-term rental mortgage refinance lenders for those with less than-perfect credit, we have a wide range of programs to choose from.

The Complete Guide to No Ratio Loans and How They Simplify Real Estate Investing

Introduction: What is a No Ratio Loan and Why Should You Consider Investing with One?

Introduction: What is a No Ratio Loan and Why Should You Consider Investing with One?

No ratio loans are a type of investment loan that does not require the borrower to show any personal income or asset documents. The only requirement is that the borrower has a high credit score based on the profit potential of the real estate rental income and the value of the property.

Credit Challenged Investors Have Options!

No DSCR Ratio: A no DSCR ratio means that you can invest without having to show your debt-to-income ratio, which would be impossible for many people because they simply don't have enough income to cover their monthly expenses.

Apartment Building Financing for Poor Credit

Credit challenged Investor loans for New Apartment Buildings

Credit challenged Investor loans for New Apartment Buildings

Multifamily real estate investing is trending, and now new apartment building loans are enabling even credit-challenged investors to participate. We can finance scores as low as 640 but we of course finance great credit sponsors as most of our clients are seasoned investors.

Multifamily is Still Hot

From coast to coast multifamily housing is in hot demand by both tenants and investors. Boston and New York are seeing their first modular apartment buildings going up, ethical investors are leveraging this sector to fill the desperate need for affordable housing, and builders are switching from sales to rentals.

January 2021 saw continued strength in multifamily starts and a 20% rise in permits, yet the National Association of Realtors has maintained that new construction still has a long way to go to keep up with demand as the expectation of the number of renters in the US are considered to rise.

A new luxury townhouse rental development on the Pacific coastline in San Diego, CA highlights how this trend is catching on at all levels of the market, while leading investment advisers like Brad Sumrok in TX promote the superior advantages of multifamily, including streamlined management.

Of course, aside from the enhanced returns, and pressure to increase urban density, one of the reasons multifamily is so popular right now is that consumers are credit challenged. This is not much different on the flip side for investors either. Many real estate investors have had their own challenges during the last seven years. Thanks to a brand new loan program from Rental Home Financing investors no longer need perfect credit to engage this niche.

Apartment Building Financing Loans Boost Performance

Those seeking to get back into the real estate industry after a break, desiring to expand their holdings, or eager to refinance their apartment buildings now that interest rates are low will find Rental Home Financing loans for multifamily offer many exciting features including…

- > 24 months out of Bankruptcy - "OK"

- Past foreclosures - "OK"

- 640 FICO minimum

- Charge offs – ok

- Up to 75% LTV

- 500k to $20,000,000

- Non-recourse options

- Competitive Interest Rates

- Up to 30 year amortization

- 3-5-7-10 year fixed rates

Contact us today to help finance your investment property portfolio.

More than just a leading U.S. Blanket Mortgage Lender, Rental Home Financing is your partner for long-term wealth building and cash flow generation. We’re invested in your long-term success. Contact us today and experience a refreshing new approach to financing investments…

Call today for more information: 1-888-375-7977 or CLICK HERE to apply online.

Rental Home Financing

9465 Counselors Way

Suite #200,

Indianapolis, IN 46240

About Rental Home Financing:

Rental Home Financing, as the best mortgage lenders we originate rental home loan products and cash out refinance investment property loans as the best investment property refinance lenders. Commercial blanket loans are available with a commercial purpose to suit your needs.

Also, as DSCR loan specialists, we are currently authorized to make such loans in most all areas of the United States. Specific circumstances will determine whether we have the ability approve/close portfolio rental home loans in your state(s). When you are ready to get a mortgage for rental property, we are ready to serve you.

Who is the best hard money loan lender to refinance with for the credit challenged?

Who is the best hard money loan lender to refinance with for the credit challenged? Introduction: What is a No Ratio Loan and Why Should You Consider Investing with One?

Introduction: What is a No Ratio Loan and Why Should You Consider Investing with One? Credit challenged Investor

Credit challenged Investor