Declining Rental Markets

Renters have been finding more deals over the last six months. According to various data compilers rents have been floating down in some previously hot markets.

The 2017 National Apartment List Report shows the fastest rental rate declines in:

- Houston, TX

- Anchorage, AK

- Washington, DC

While national rent averages are up, there have been declines in cities from coast to coast. Some of the most notable include the following.

- San Francisco, CA

- Manhattan, NY

- Sunnyvale, CA

- Oakland, CA

- Cambridge, MA

- El Paso, TX

Best Cities for Rental Property Growth

At least when it comes to multifamily property, Freddie Mac poses that some notable markets should see rents bounce back in 2017, with income growth rates between 4.2% to 6.4%.

- This includes:

- Sacramento, CA

- Seattle, WA

- Portland, OR

- Phoenix, AZ

- Tampa, FL

- Chicago, IL

- Jacksonville, FL

- Los Angeles, CA

Business Insider’s list of best places to invest in rental property this year for rental growth include; Detroit, Dallas, Orlando, and Atlanta.

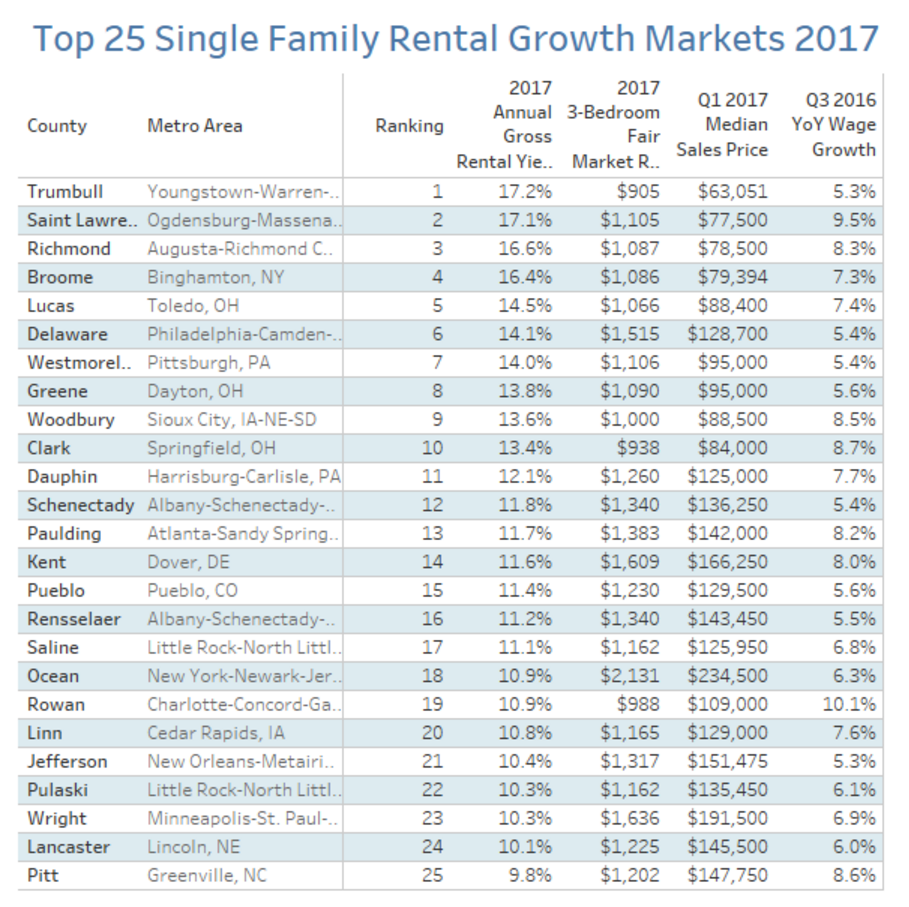

The World Property Journal and ATTOM Data recommend this list for fast rental growth rates in 2017.

The Quirks & Pivots

It is also important to watch other factors which may alter the organic rates of growth we would otherwise see.

- This year it includes:

- Record setting hurricane damage

- The massive Equifax data hack

- Interest rates

- Summary

The above data suggests that this is both a great time to get in and scale rental property portfolios. Investors should still monitor trends and local market fundamentals to evaluate where the best rental rate growth can be expected. Another major driver this year, is continued low interest rates (for now), and the availability of rental home financing. There are some uncertainties, but what most are sure of is that it is hard to beat the current environment for making new acquisitions, if you know where to find good deals.